- Heating

-

-

-

Interested in Financing?

We offer financing to keep your family’s budget on track.

Apollo Care Plan

Regularly maintained heating and cooling components work the best!

-

-

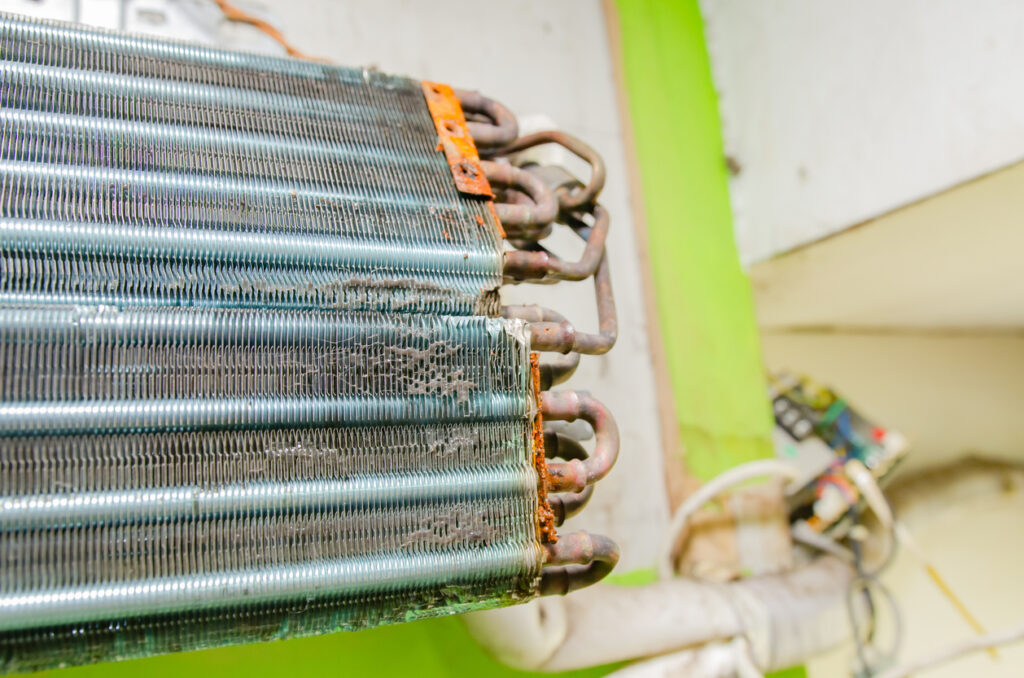

- Cooling

-

-

-

Interested in Financing?

We offer financing to keep your family’s budget on track.

Apollo Care Plan

Regularly maintained heating and cooling components work the best!

-

-

- Plumbing

-

-

-

Interested in Financing?

We offer financing to keep your family’s budget on track.

Apollo Care Plan

Regularly maintained heating and cooling components work the best!

-

-

-

-

- Sewer & Drain

-

-

-

Interested in Financing?

We offer financing to keep your family’s budget on track.

Apollo Care Plan

Regularly maintained heating and cooling components work the best!

-

-

-

- Electrical

-

-

-

Interested in Financing?

We offer financing to keep your family’s budget on track.

Apollo Care Plan

Regularly maintained heating and cooling components work the best!

-

-

- Indoor Air Quality

-

-

-

Interested in Financing?

We offer financing to keep your family’s budget on track.

Apollo Care Plan

Regularly maintained heating and cooling components work the best!

-

-

- Commercial

-

-

-

Interested in Financing?

We offer financing to keep your family’s budget on track.

Apollo Care Plan

Regularly maintained heating and cooling components work the best!

-

-

-

- Deals

- Resources

- About

- Contact Us

- Schedule Online

- 7 Days a Week (513) 443-4212