Jan / 2024

Apollo Blog

Jan / 2024

What’s Included in a Furnace Tune-Up Checklist?

Sep / 2021

Fall in Love with Duct Cleaning

Aug / 2021

Top Ways to Stay Cool and Save This Summer

May / 2021

Tips for Managing Spring Allergies

Apr / 2021

How to Make Your HVAC System Work Efficiently

Mar / 2021

Tips to Jump Start your Spring Cleaning

Mar / 2021

Signs your Home Needs an Electrical Panel Upgrade

Feb / 2021

Presidential Comfort: White House HVAC and Plumbing Facts

Feb / 2021

Hello world!

Jan / 2021

Preventing the Problem of Frozen Pipes

Jan / 2021

Ten Ways to Save Money Under Your Roof in the New Year

Dec / 2020

Making your Holiday Merry and Bright…Safely

Dec / 2020

Smart Home Automation is Simple with Nest Products and Apollo Home

Nov / 2020

Top Thanksgiving Foods that Cause Holiday Havoc in your Drains

Nov / 2020

Five Tips to Get your Home Ready for the Holidays

Oct / 2020

Creepy House Noises You Shouldn’t Ignore

Oct / 2020

Are Your Smoke Detectors Up to Code and Protecting Your Home?

Sep / 2020

Why Early Fall is the Best Time for an HVAC Tune Up

Sep / 2020

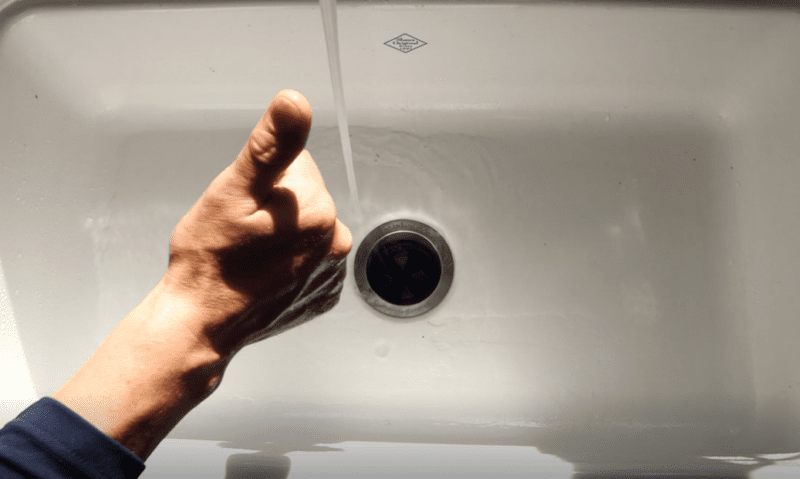

What Items Are Safe to Put Down Your Drains?